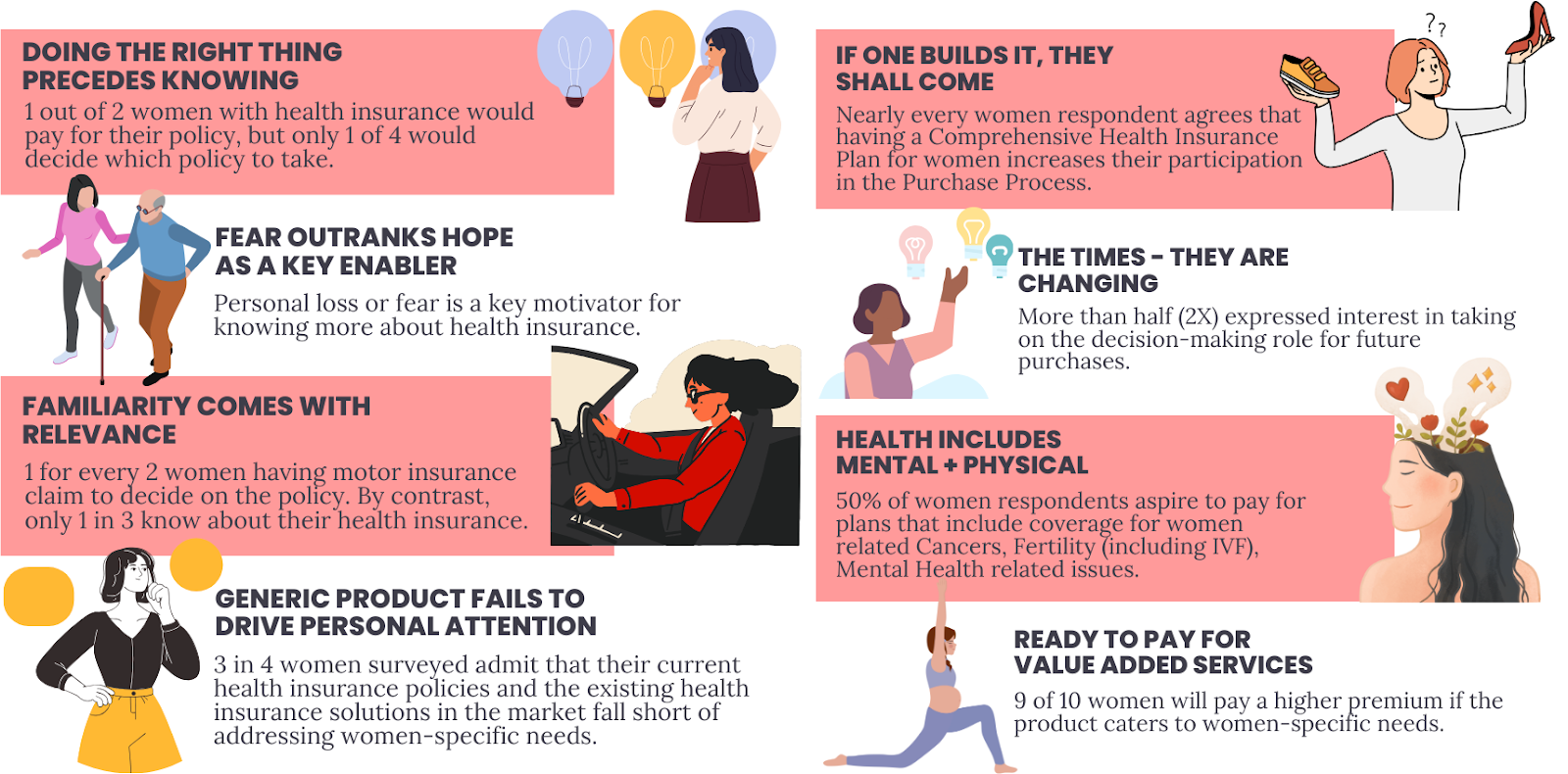

Health insurance plans are too generic to warrant the attention of Indian women

- 74% of Indian women don’t get involved in decision-making when it comes to health insurance

- 75% of women believe that existing health insurance policies fall short of addressing women-specific needs

- 94% of the respondents agree that having a comprehensive health insurance plan for women would increase participation in the purchase process

- The survey was conducted by Unomer among ~600 women health insurance owners and intenders across India, with 80% aged between 21-35 years

- Sensing the demand gap, Future Generali India Insurance launched HEALTH POWHER – one of the most comprehensive policies to empower women and cater to their varied health needs

Mumbai, March 07, 2024: Future Generali India Insurance Company, one of India’s leading private general insurance players, today announced the findings of #PowHer Survey - an exclusive survey powered by Unomer. The survey focused on gauging the pulse of Indian women when it comes to buying health insurance.

Commenting on the initiative, Anup Rau, Managing Director and CEO, Future Generali India Insurance Company Ltd, said, “At Future Generali, we believe that the key to unleashing the potential of health insurance in India lies in expanding the market by customising solutions to address every conceivable homogeneous group, however small. But, today, we are here to address the largest under-served group in India, which also happens to be India’s largest minority by any measure - and that group is women! At Future Generali, we are here to offer women a product customised to their needs and requirements, a product that promises to be unique in more ways than one, a product designed through deep research and understanding of what women want. This product is designed through rigorous research- by the women, for the women - and we are proud to put it out to the market.”

Towards bridging this gap, Future Generali today also announced the launch of its most comprehensive women-health insurance plan – designed to meet the unique needs of women.

FGII “HEALTH POWHER” aims to address the various needs of women across the different stages of their lives. Some of the critical differentiators of HEALTH POWHER include Enhanced Limits for Female Cancer treatments, Coverage for Puberty and Menopause-related disorders, OPD focus on physical & mental well-being with the reinstatement of mental illness benefit to 200%, Coverage for infertility treatment & Oocyte cryopreservation, Stem Cell Storage, a comprehensive wellness program, Lumpsum benefit for Newborn defect, Nursing care, Senior Care covering bone strengthening injections, joint injections etc., Enhanced maternity benefits with the inclusion of Antenatal cover, and many more.

Besides, the policy also covers a host of value-added services, Annual health check-ups & preventive care packages, fitness programs, diet & nutrition, spa wellness, gynaecological consultation, yoga, and others, making it a unique assimilation of preventative and comprehensive healthcare plans.

For a country like India, where women comprise roughly half of the nation’s population, at around 49 per cent, less than one-third, or only about 30%, of them aged 15-49, were covered under health insurance between 2019-2021, as per data fetched from the National Family Health Survey India report.

About Future Generali India Insurance Company Limited:

Future Generali India Insurance Company Limited is a joint venture between the Generali Group, a 190-year-old legacy global insurance business with a 74% majority stake, and the Future Group. The Company was set up in 2006 to provide retail, commercial, personal, and rural insurance solutions to individuals and corporates to help them manage and mitigate risks. FGII broke even in FY 13-14 - a landmark achievement in just six years of operations.

Today, with over Rs. 6,748 Crore of assets under management in FY 2023, Gross Written Premium of Rs. 4,627 Crore, Future Generali India Insurance has firmly established its credentials in the insurance segment. Currently, amongst India’s top 10 private general insurance players, Future Generali became a ‘Great Place to Work’ certified company for the 5th time in a row (October 2023–October 2024) as per the prestigious Great Place to Work® Institute. The Company is the proud recipient of several awards and recognition, the most recent being the Golden Peacock Awards 2022 for Excellence in Corporate Governance and The Economic Times Best Brands Awards 2022.

About Generali Group

Generali is one of the largest global insurance and asset management providers. Established in 1831, it is present in over 50 countries, with a total premium income of € 81.5 billion in 2022. With 82,000 employees serving 68 million customers, the Group has a leading position in Europe and a growing presence in Asia and Latin America. At the heart of Generali’s strategy is its Lifetime Partner commitment to customers, achieved through innovative and personalised solutions, best-in-class customer experience, and digitalised global distribution capabilities. The Group has fully embedded sustainability into all strategic choices to create value for all stakeholders while building a fairer and more resilient society.

About Unomer

Unomer is a leading mobile market research platform. It reaches millions of consumers through a network of mobile apps and gathers consumer insights, feedback and opinions through interactive in-app survey

Future Generali India Insurance Company Limited (IRDAI Regn. No. 132), (CIN: U66030MH2006PLC165287)| Regd. and Corp. Office: Unit No. 801 and 802, 8th floor, Tower C, Embassy 247 Park, L. B. S. Marg, Vikhroli (W) Mumbai- 400083| Website:https://general.futuregenerali.in| Email: fgcare@futuregenerali.in| Call us at: 1800-220-233 / 1860-500-3333 / 022-67837800| Fax No: 022 4097 6900| Health PowHER UIN: FGIHLIP24180V012324

Trade Logo displayed above belongs to M/S Assicurazioni Generali - Societa Per Azioni and used by Future Generali India Insurance Co. Ltd. under license.| For detailed information on this product including risk factors, terms and conditions etc., please refer to the product policy clause, consult your advisor or visit our website before concluding a sale. Health Products are eligible for deduction under section 80D of the Income Tax Act. Tax benefits are subject to change due to change in tax laws. ARN: FG-NL/PD/MKTG/EN/HEALTHPOWHERPRSSRELEASMARCH2024